How to Choose a Sustainability Reporting Framework | ESG Basics

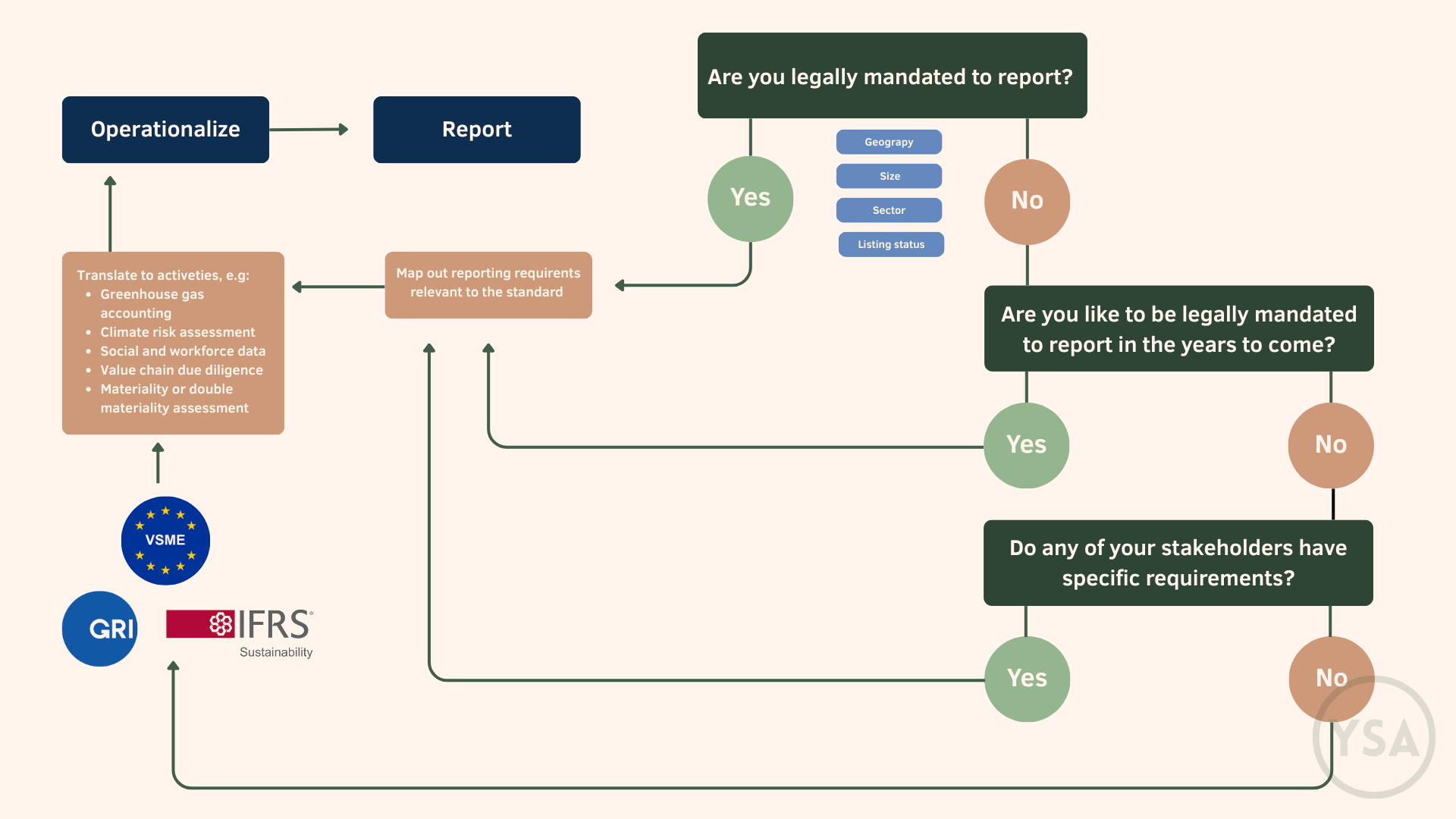

Feb 06, 2026Choosing a sustainability reporting framework can feel overwhelming. There are many options, and companies often assume the decision is subjective. In reality, it is usually a logical sequence of questions.

This blog post follows the same decision tree used in the ESG Basics video so you can work through the choice step by step.

Step 1: Are you legally required to do sustainability reporting?

Start by establishing whether you have a legal reporting obligation. This is typically determined by four factors:

-

Geography: Where your company is headquartered, where it operates, and where it is listed

-

Company size: Thresholds such as number of employees, turnover, or revenue

-

Sector: Some industries face additional or earlier requirements

-

Listing status: Listed companies often have stricter disclosure obligations

If the answer is yes, your framework choice is largely made for you. The relevant regulation will specify which standard you are expected to follow.

Depending on your context, this could include requirements such as:

-

CSRD in the EU

-

CSDS for listed companies in China

-

Sector-specific requirements, such as IMO in shipping or ICAO in aviation

The key benefit of being legally mandated is clarity. You are not guessing what “good reporting” looks like. You are working toward a defined set of requirements.

Step 2: If yes, translate the standard into the activities you must do

Once you know which standard applies, the next step is to map the requirements into concrete activities. This means identifying what you must actually do to comply, not just what you must publish.

Across most regulations and standards, the core activities are surprisingly similar. They typically include:

-

Greenhouse gas accounting, often across multiple scopes

-

Climate risk, including how climate impacts the business and how the business impacts climate

-

Social and workforce data, such as safety, working conditions, and key people metrics

-

Value chain due diligence, including supplier and downstream considerations

-

A materiality assessment, meaning the process used to decide what topics you will report on

There will be variations, especially where sector-specific requirements apply, but these building blocks show up repeatedly across different frameworks.

Step 3: Operationalise the activities

After you have defined the required activities, the real work starts. Sustainability reporting is not only a reporting exercise. It is a systems and process exercise.

Operationalising means setting up the internal machinery needed to produce reliable sustainability information.

In practice, this usually includes:

-

Defining who is responsible for each topic and data set

-

Mapping where the data sits and how it is recorded

-

Establishing quality control, review, and approval processes

-

Setting up a reporting calendar and internal routines

-

Ensuring you can compile the output into the required reporting format

This is the part many companies underestimate. The reporting framework is the structure, but your internal systems are what make reporting possible.

Step 4: If no, are you likely to be legally mandated in the coming years?

If you are not legally required to report today, the next decision tree question is whether you are likely to be required to report in the future.

This can happen if:

-

Regulations expand in your geography or sector

-

Your company grows and crosses size thresholds

-

You plan to list or raise capital in markets with stronger disclosure expectations

-

Your customers operate under regulation and pass requirements down the value chain

If the answer is yes, the best approach is to act as if reporting were already mandatory. Sustainability reporting takes time, and waiting until the last moment usually creates unnecessary pressure.

Starting early gives you time to build systems, test data collection, and improve quality before reporting becomes legally required.

Step 5: If not regulation, do any stakeholders have specific requirements?

If you are not regulated and do not expect to be soon, the next step is to look at stakeholder expectations.

This is most commonly driven by:

-

Investors

-

Banks and lenders

-

Insurers

-

Large customers, especially in regulated markets or complex value chains

Even when reporting is voluntary from a legal perspective, these stakeholders may still require sustainability disclosures or data. If a key stakeholder asks you to report in a certain way or follow a specific framework, the decision is effectively made. Meeting stakeholder expectations often affects access to capital, commercial relationships, and long-term competitiveness.

Step 6: If there are no clear requirements, choose a voluntary framework

If you reach this point in the decision tree, you are in the voluntary reporting space. Many companies then choose between three commonly used options:

-

GRI

-

VSME

-

IFRS Sustainability Standards (S1 and S2)

All three can result in a sustainability report, but they serve different needs and can be implemented in simpler or more advanced ways depending on your maturity and capacity.

If you are unsure which of these fits best, the key is to select a starting point that matches your size, stakeholder expectations, and internal resources. It is often better to start with a manageable framework and build over time than to choose a complex framework you cannot deliver properly.

Final takeaway

There is no single sustainability reporting framework that fits every company.

The right framework depends on where you sit in the decision tree:

-

Are you legally required to report?

-

Are you preparing for future regulation?

-

Do stakeholders have specific expectations?

-

Or are you choosing a voluntary starting point?

Frameworks are tools, not goals. The real value comes from building the activities, systems, and processes behind the reporting.

If you want to strengthen your understanding of the key reporting activities and how to operationalise them, you can explore the Beginner’s Guide to ESG, which is designed as a practical crash course in corporate sustainability and sustainability reporting.