China’s New Sustainability Reporting Rules: What European Companies Need to Know

Aug 15, 2025

China is moving quickly to tighten its corporate sustainability disclosure rules. In 2024, the Ministry of Finance introduced the draft Chinese Sustainability Disclosure Standards (CSDS). This framework will eventually require most companies in China to publish detailed ESG data.

The CSDS draws heavily from the EU’s Corporate Sustainability Reporting Directive (CSRD) and the ISSB Standards, meaning it shares core principles like double materiality and climate risk disclosure. The result is a reporting system that will be broadly recognisable to European investors and regulators, yet tailored to China’s own economic priorities.

For European companies that trade with, operate in, or source from China, this is not just a local compliance story. It will influence how data is collected, verified, and communicated across global operations and supply chains.

The Core of the CSDS

The CSDS is built on three pillars:

Basic Requirements:

Mandatory governance, environmental, and social disclosures for all sectors, including details on strategy, risk management, and performance metrics.

Thematic Standards:

More specialised requirements on topics such as carbon emissions, water use, biodiversity, and workforce diversity, rolled out over time.

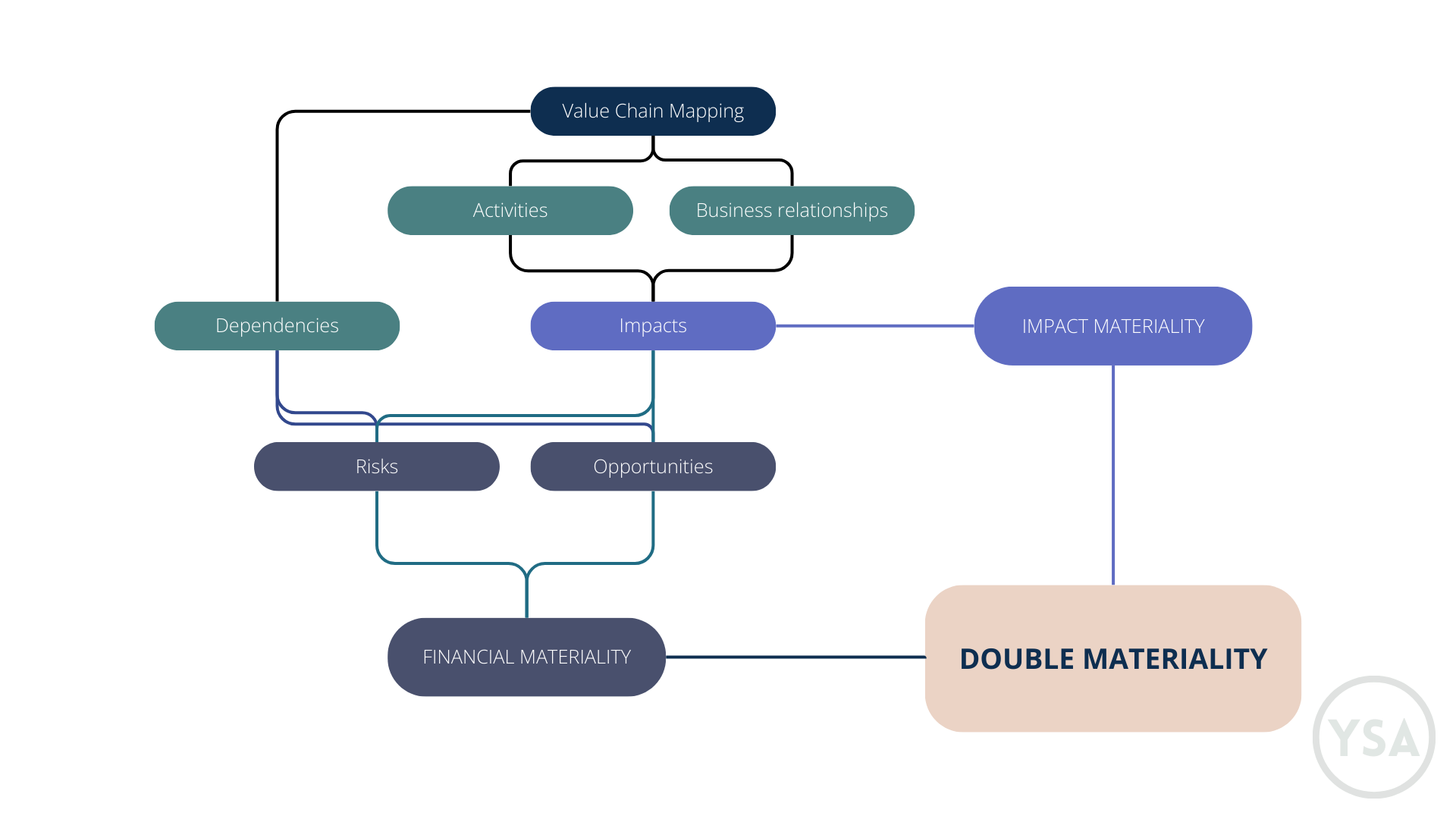

Double Materiality:

Companies must report on both how sustainability issues affect their business and how their activities affect the environment and society.

This alignment with international norms should make Chinese reports more comparable with European ones, reducing some of the friction global companies face when consolidating disclosures.

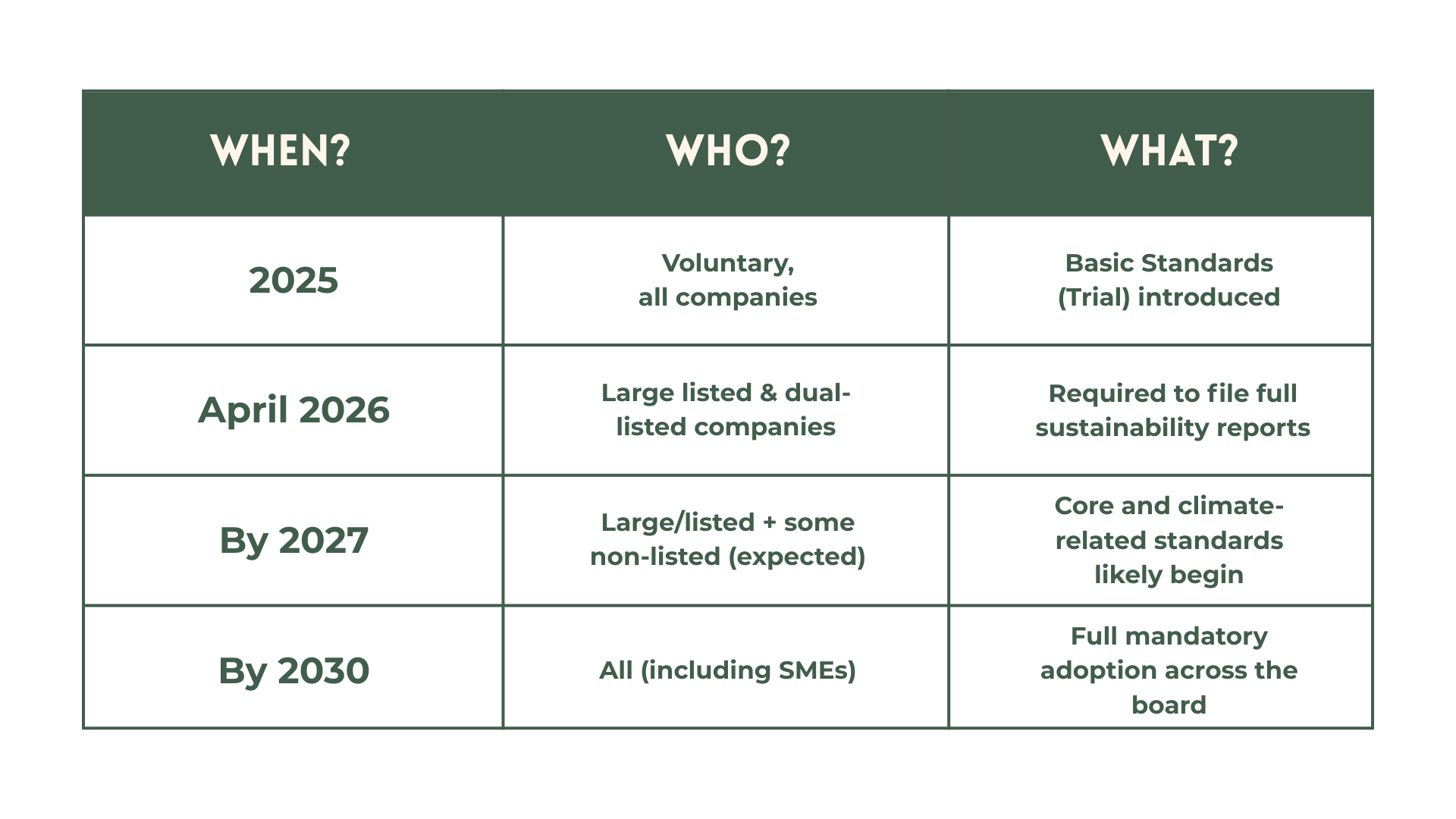

Gradual Implementation

China is phasing in the requirements:

This staged rollout is designed to give companies time to develop the systems and expertise needed to meet the new requirements.

This staged rollout is designed to give companies time to develop the systems and expertise needed to meet the new requirements.

Why It Matters for European Companies

The CSDS will have knock-on effects for many European firms, particularly those with Chinese suppliers or joint ventures. Key impacts include:

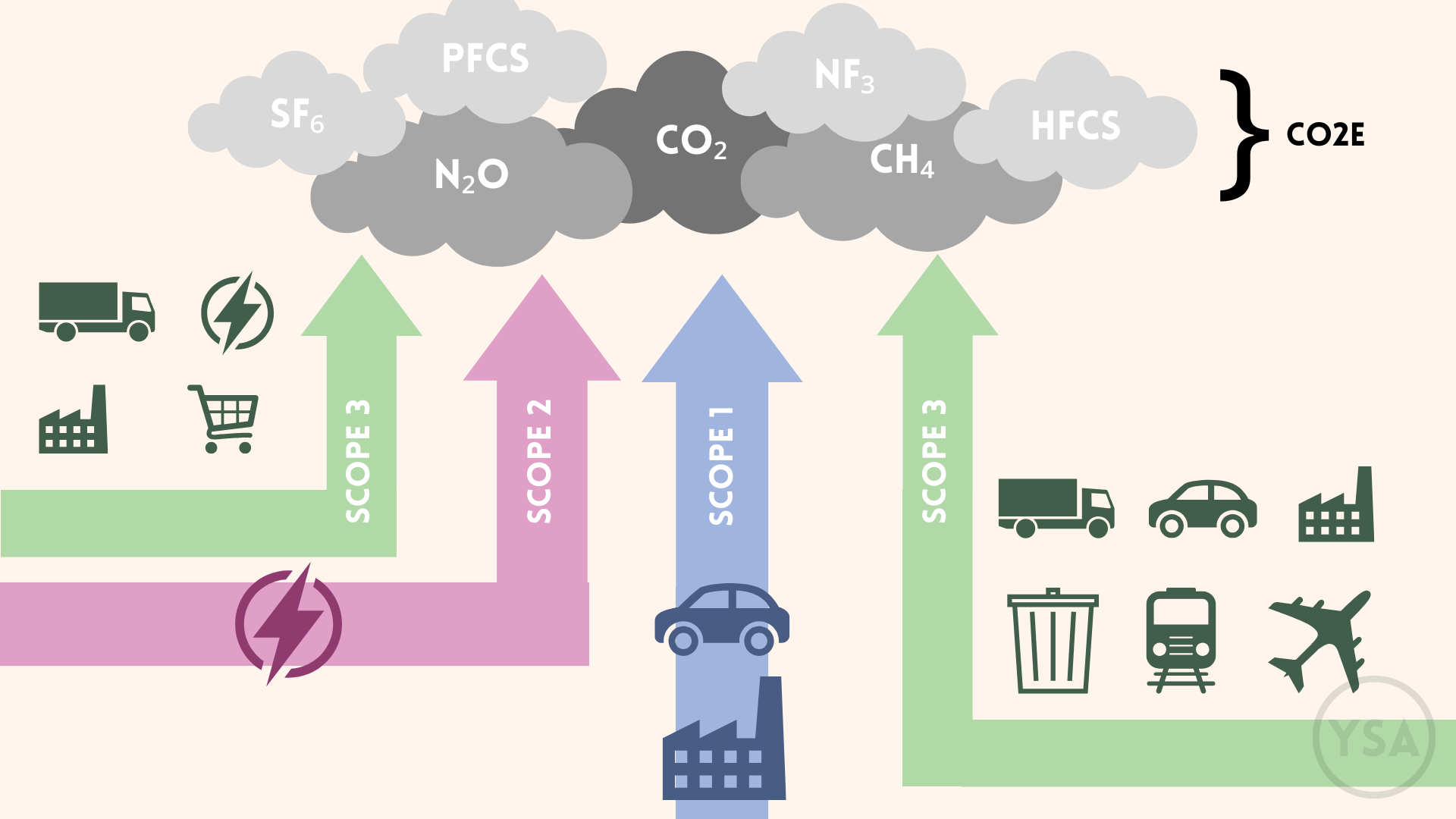

Expanded GHG Emissions Tracking

- Scope 1, 2, and often Scope 3 emissions data will be required.

- European firms will need to ensure Chinese partners can provide verified emissions figures that match EU reporting quality.

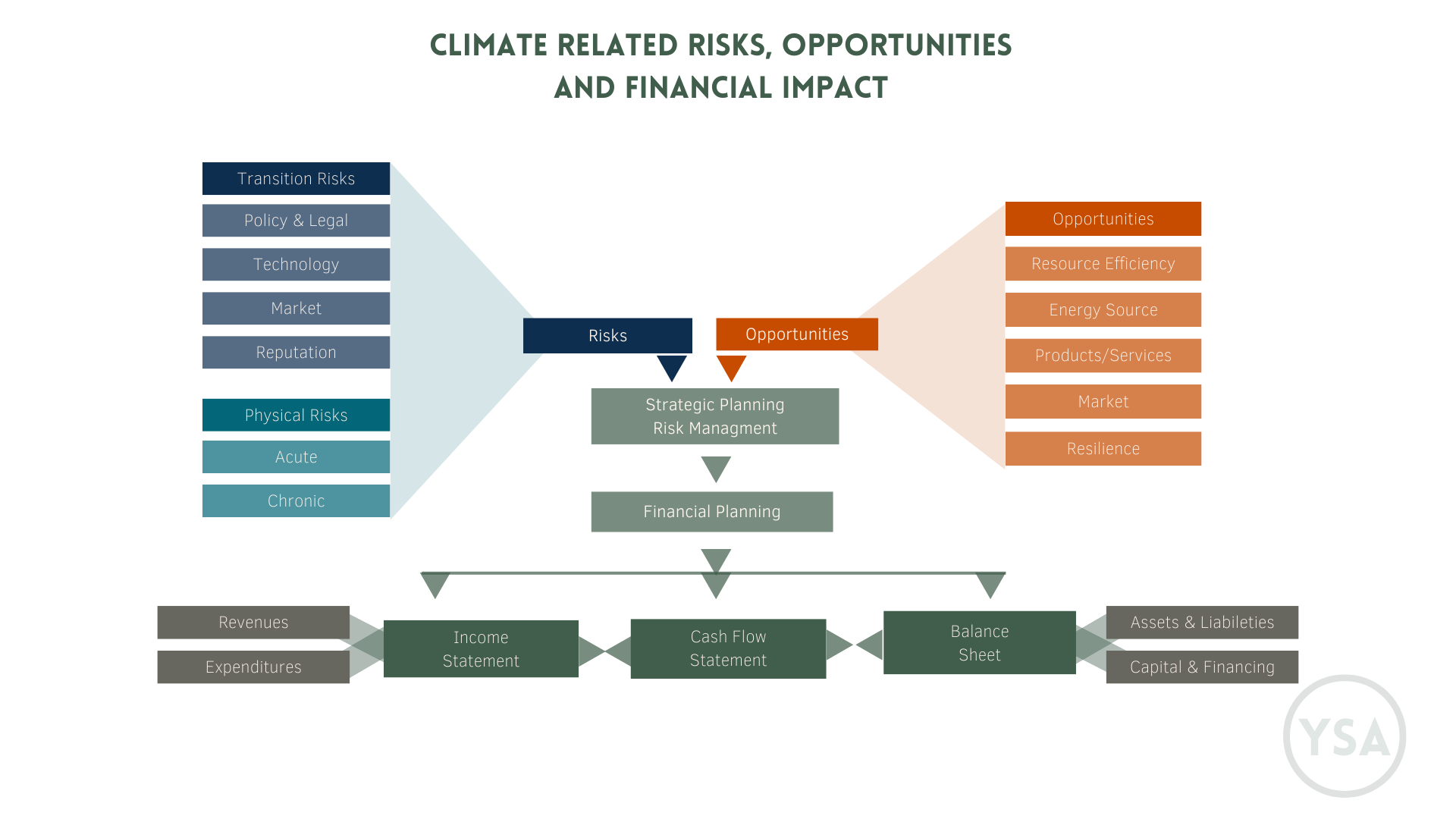

Climate Risk and Scenario Analysis

-

The CSDS will demand forward-looking assessments of climate-related risks and opportunities.

-

This aligns with CSRD expectations, meaning joint methodologies could be used to meet both regimes.

Double Materiality

- Both EU and Chinese rules require reporting on business impacts and dependencies.

- European companies will need to integrate supply chain impacts from China into their global double materiality assessments.

Deeper Supply Chain Transparency

- Industry-specific requirements will compel Chinese suppliers to share more ESG data.

- This may improve visibility but also increase the compliance workload for European buyers.

Stronger Data Management and Assurance

- Robust systems for collecting, validating, and storing ESG data will be essential.

- Companies should anticipate third-party assurance becoming standard in both jurisdictions.

Preparing Now

The smart move for European businesses is to start aligning internal processes with the CSDS before it becomes fully mandatory. Steps to consider include:

-

Expanding data collection systems to cover Chinese operations and suppliers.

-

Running global risk and double materiality assessments that satisfy both EU and Chinese requirements.

-

Establishing ESG reporting expectations in supplier contracts.

-

Investing in tools and training for consistent emissions and risk reporting.

China’s sustainability disclosure framework is on track to become one of the most comprehensive in the world. For European companies, early alignment will not only ease compliance but also strengthen transparency, investor confidence, and supply chain resilience. The CSDS may be a Chinese regulation, but its influence will be felt far beyond China’s borders.

The Good News

While the CSDS may sound like a brand-new layer of complexity, the truth is that the core activities it requires are already familiar to companies working under global sustainability frameworks. The real focus is not on reinventing the wheel but on doing the fundamentals well.

That means getting the building blocks in place:

Greenhouse Gas Accounting:

Measuring and reporting your Scope 1, 2, and relevant Scope 3 emissions accurately.

Risk and Opportunity Assessment

Identifying and evaluating climate and ESG-related risks and opportunities, including scenario analysis.

Double Materiality Analysis

Understanding both how sustainability issues affect your business and how your operations affect society and the environment.

If your company can perform these activities robustly, aligning with CSDS becomes far less daunting. The same skills, systems, and data you develop for EU compliance can be leveraged in China - and vice versa.

For companies that need guidance, YouSustainAcademy offers training on all these core practices, helping teams and individuals build the capabilities needed to meet both EU and Chinese requirements. If you prefer hands-on support, you can also book a call with one of our experts to get tailored advice and implementation help.